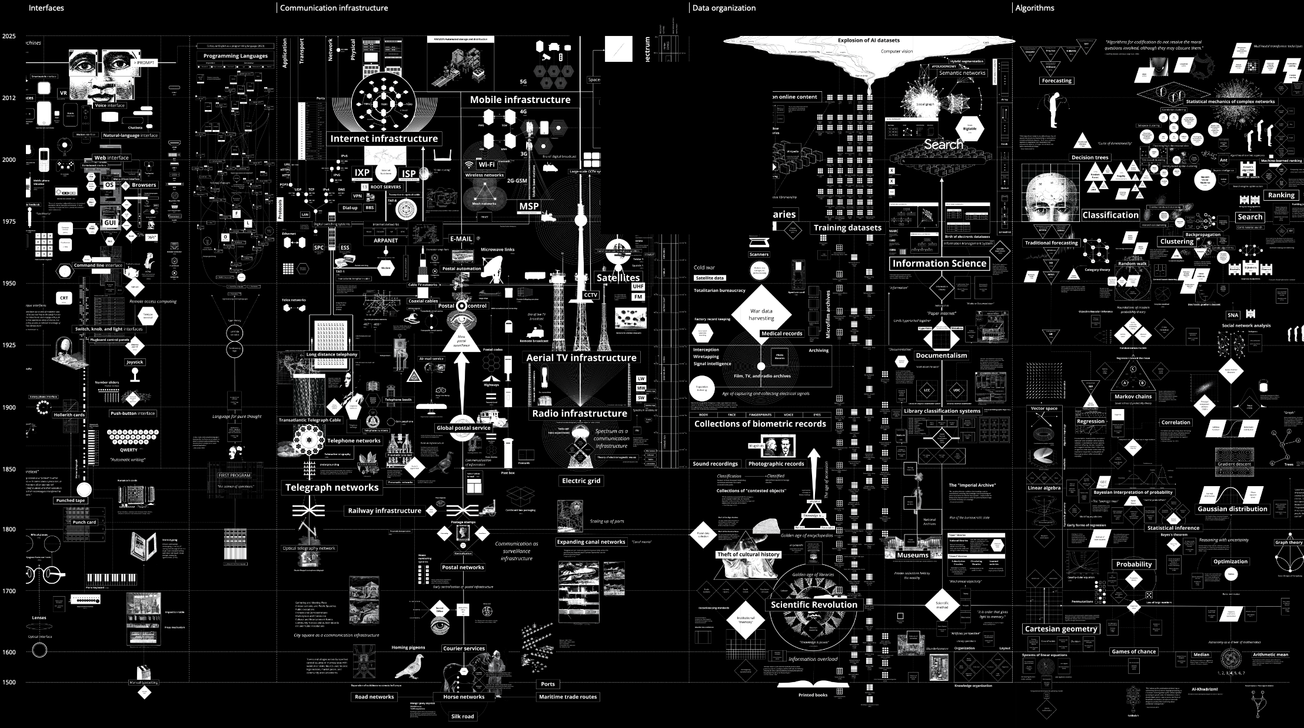

The global art market, valued at $67.8 billion in 2023 (Art Basel and UBS), is not typically a hotbed of technological upheaval. Galleries still reign, auction houses still gatekeep, and artists still struggle with long-standing issues of access, equity, and control. But a parallel system is emerging—one built not on marble floors and exclusive openings, but on distributed ledgers, smart contracts, and tokenized economies.

This isn’t another hype cycle. While the NFT mania of 2021 may have inflated expectations (and valuations), the infrastructure it introduced—blockchain-native ownership, programmable royalties, and decentralized creative networks—is quietly reshaping the art world’s foundation.

Tokenized Art and the Shift to Creator Economies

NFTs—non-fungible tokens—aren’t new anymore. But their implications are still being absorbed. Built primarily on blockchains like Ethereum, Tezos, and Solana, NFTs function as verifiable certificates of authenticity and ownership. That matters in a market where provenance is everything.

In 2021, NFT sales volume exceeded $17 billion, but that bubble has since deflated. Today, the NFT market hovers at around $1.2 billion per quarter, according to NonFungible.com and DappRadar. What’s changed is the use case. The initial gold rush has given way to more grounded experimentation—artists releasing time-based works, interactive pieces, even generative collections that evolve based on code or collector actions.

Platforms like SuperRare, Foundation, and Zora allow creators to mint and sell works without intermediaries. The interfaces look like galleries; the mechanics operate more like DeFi. Artists can set their own prices, define edition sizes, and determine how their work circulates—all without waiting for institutional validation. Still, NFTs are only as powerful as the contracts that govern them.

Smart Contracts and the Economics of Creative Control

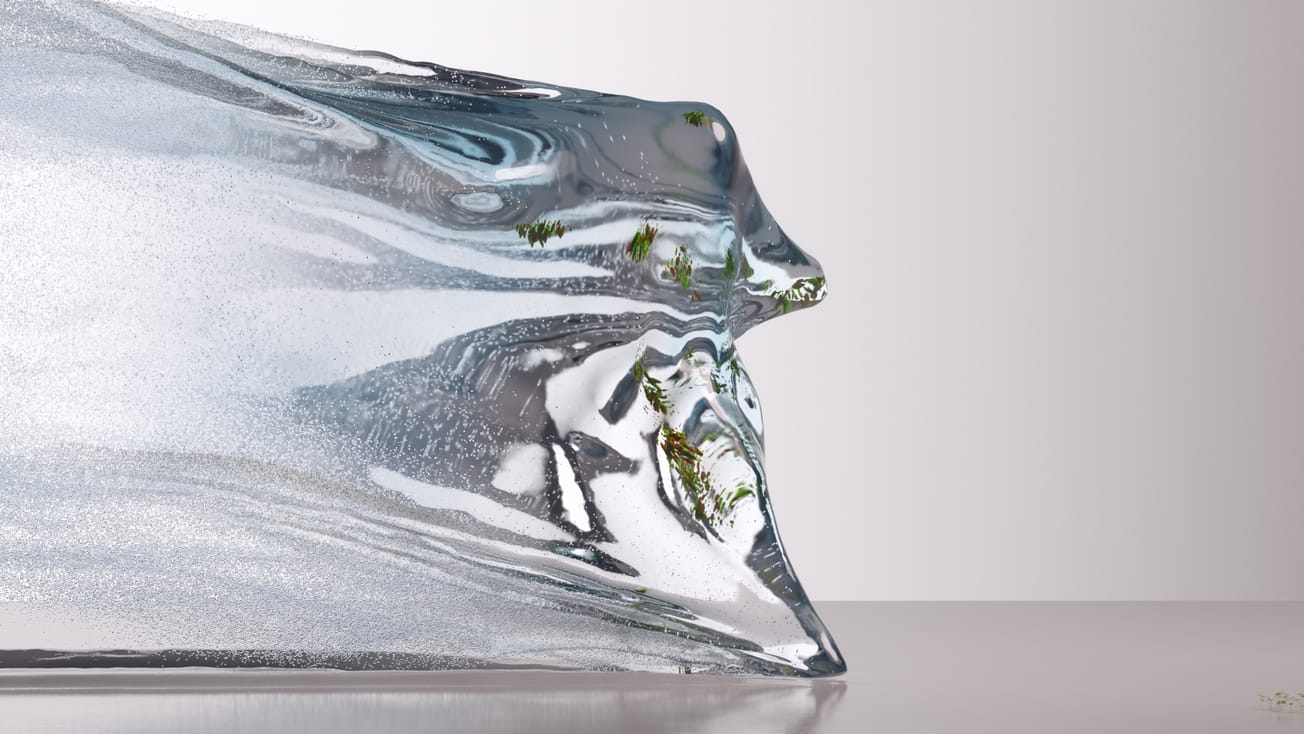

The real breakthrough isn’t the token—it’s the code beneath it. Smart contracts—self-executing programs embedded in blockchains—allow artists to define the terms of engagement with their work. When a digital piece is minted as an NFT, the contract might include a 10% resale royalty, automated revenue splits, or unlockable files tied to ownership.

Compare that to the traditional market, where resale royalties are inconsistent at best. In the U.S., there's no federal right to royalties, and enforcement often relies on contracts that are expensive to litigate. Blockchain automates all of this: no third party needed, no delay in payment. This is already playing out on platforms like Manifold, which lets artists deploy their own custom smart contracts, and Async Art, where multi-layered works can be updated or interacted with in real time.

Ownership, too, becomes more flexible. A collector might buy a limited-edition digital painting, but also gain exclusive access to behind-the-scenes content, membership in a DAO, or rights to exhibit the piece in VR. Fractional ownership—splitting a single work among multiple holders—is also gaining traction, allowing shared value models that weren’t possible in traditional art finance. Not all platforms enforce royalties equally. Blur and even OpenSea have at times allowed buyers to bypass royalty payments, undermining the very contracts artists rely on. This has spurred moves to hard-code royalties at the protocol level, making them non-negotiable. It’s not just a fight over percentages—it’s a struggle for creative sovereignty.

A New Market Layer: Sustainable, Programmable, and Still Evolving

The early backlash against NFTs wasn’t just about speculation. The environmental impact of Ethereum's proof-of-workmodel drew sharp criticism—and for good reason. Before its 2022 upgrade, Ethereum’s energy consumption rivaled that of entire nations. That changed with The Merge. Ethereum now runs on proof-of-stake, cutting energy usage by over 99.9%. Other chains like Tezos, Polygon, and Solana were designed to be efficient from the start, and have become go-to networks for eco-conscious creators.

With sustainability less of a barrier, the bigger challenge now is usability. Setting up wallets, securing seed phrases, paying gas fees—it’s a far cry from uploading a JPEG to Instagram. But platforms like Manifold, Kudos, and Mintbaseare working to make onboarding frictionless, especially for creators who don’t code. Meanwhile, decentralized infrastructure is gaining ground. Instead of hosting work on centralized servers, artists are turning to distributed storage via IPFS or Arweave. Protocols like Zora allow artists to build their own minting experiences or even spin up marketplaces—no gallery approval required.

But with freedom comes complexity. Blockchain doesn’t remove the need for trust, curation, or cultural context—it just redistributes where those decisions happen. DAOs are experimenting with community-led funding and curation models, but coordination and governance remain challenging. Still, the shift is underway: from gatekeeping institutions to artist-owned infrastructure.

The big picture? Blockchain won’t replace the existing art world. It’s building a parallel one—programmable, global, and increasingly interoperable. Artists no longer need to wait for permission. They can set the rules, build their markets, and bring their collectors along for the ride.